BidHub.tv, a cautionary tale about fraud in advertising

Programmatic ad fraud gets so much attention that it’s easy to forget there is still a large amount of regular fraud that occurs in advertising. This fraud isn’t tied to the programmatic auctions, and happens because of the black box that is ad tech. When I released a white paper on Weasel, we showed how the company Mobideck was ads.txt compliant and their app was approved for monetization on numerous SSPs and ad networks, even though the app in question (wease.im) was not fully functioning and didn’t seem to have any real users. This issue is actually pretty rampant; companies present themselves as one thing to a buyer, then go and sell traffic that is either different or sold on false pretenses. I call these companies “Ghosts,” and digital advertising is littered with them. What follows is a real life scenario of a Ghost company, how they came to be, what they did, and why the industry needs to take a hard stance on preventing them.

In 2018 I was approached by a company called BidHub.tv. They presented themselves as a New York based company with quality traffic. We engaged in an IO after some initial due diligence and placed a credit cap on them.

Things started out pretty quiet, but some red flags started popping up into the third and fourth month of the relationship. Their traffic started to grow, but I was concerned about a few things related to the prices I was seeing, and began looking at the company more closely.

The concern was that the prices being offered to us for the video inventory being sold were too low, and logically bids at those prices shouldn’t be clearing at the rate I was seeing. I checked ads.txt and everything seemed authorized, but the price thing warranted a closer look. What I uncovered was unexpected.

Who was BidHub.tv LLC

The Company

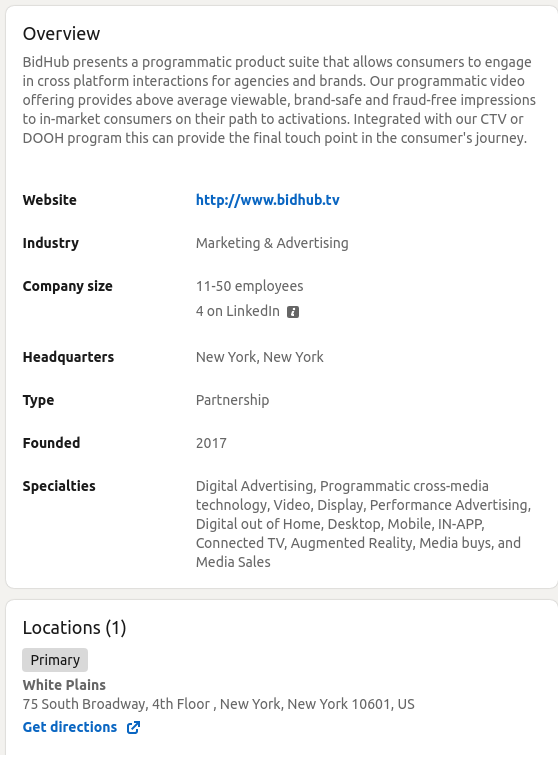

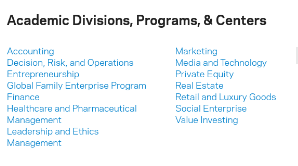

This is where I started my analysis to discover how they were sourcing their traffic at such low prices. They had 4 employees listed on Linkedin, but claimed to be between 11–50 employees in size. They also claimed they were headquartered in New York, NY, and founded in 2017.

BidHub.Tv LinkedIn Page (captured in 2019)

BidHub.Tv LinkedIn Page (captured in 2019)

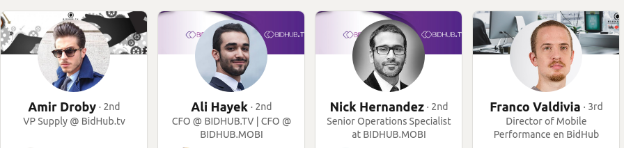

They only listed 4 employees on linkedin according to their page, and the individual who represented them was Brian Greenwalt, so we could add him to the list of employees, bringing the total to 5. (Note: as of November 2022, two of these profiles still exist on LinkedIn.)

BidHub.tv Employees (2 are still present on LinkedIn today)

BidHub.tv Employees (2 are still present on LinkedIn today)

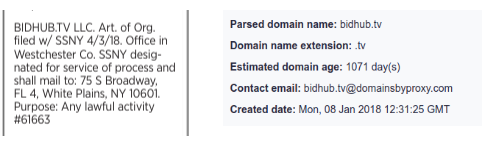

Next, some fact checking occurred: first off, BidHub.tv LLC was not founded until 4/3/18 according to their articles of incorporation, verified by two sources. So their claim of being founded in 2017 was incorrect; while a small issue, it is still a false claim. Also, the website bidhub.tv was registered in Jan 2018.

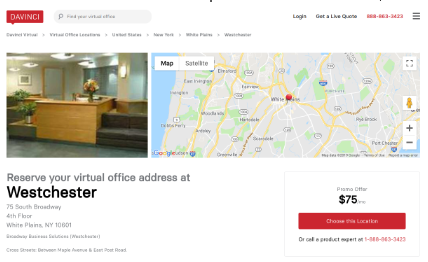

Then we checked the address of the company, 75 South Broadway, 4th Floor, White Plains, NY, 10601. Turns out the address in question is not a real office, but a virtual office you can buy.

There is nothing inherently wrong with having a virtual office — many use them, especially now during COVID. But this information became especially important when I began digging deeper into the employees of BidHub.tv.

The Employees

I determined that at least 6 people claimed to be from BidHub, either from LinkedIn or from our own communications: Brian Greenwalt, Ali Hayek, Fahim Golani, Nick Fernandez, Amir Drobhy, and Franco Valdiva. The first four of these actively sent communications to us.

Brian Greenwalt

We first started with Brian Greenwalt. He was listed as the COO of BidHub.tv and claimed to be based in the United States. (He has since scrubbed his profile of all mention of BidHub.)

However his top entry listed his location in Spanish. His photo shown below was interesting in that it was a picture taken in Barcelona, specifically at the intersection of Passeig de Gracia and C\ d’Arago (see picture below).

Now this on its own didn’t tell us much; there is nothing wrong with someone posting a photo of themselves in a foreign country as their LinkedIn profile image. But it was odd.

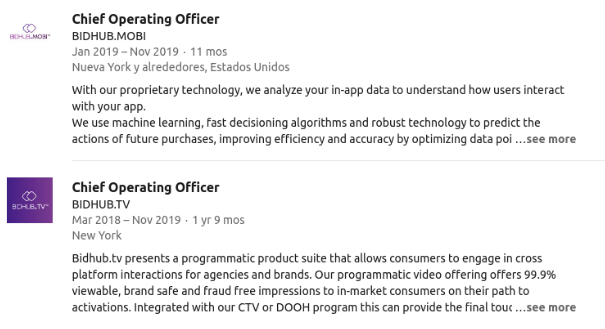

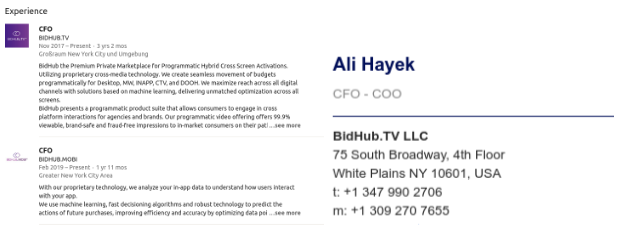

Ali Hayek

Ali Hayek was listed as the CFO, which was odd considering in his email he listed himself as the COO and CFO. Maybe they had dual COOs? I found this unusual.

His photo was also interesting: it looked almost like a stock image. A little digging showed us why…

So Ali Hayek’s photo was fake. Upon more aggressive research I found no evidence that a person by this name ever attended or earned an MBA from University of Chicago.

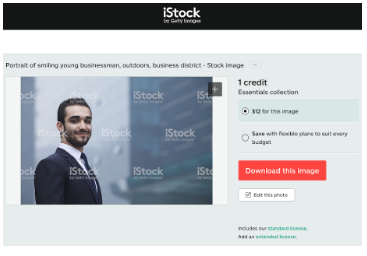

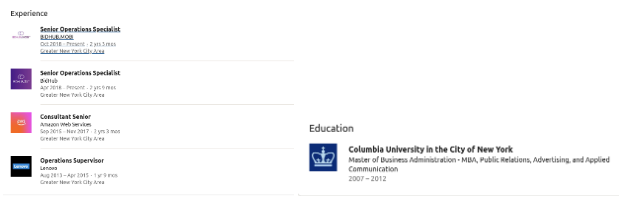

Nicholas Hernandez

Next we looked at Nicholas Hernandez. He was listed as the Senior Operations Specialist and earned an MBA from Columbia, in Public Relations, Advertising and Applied Communications. (Note as of November 2022, this profile no longer exists on LinkedIn.)

All of this sounded pretty normal, but something about the profile photo didn’t look right. The back lighting, the softness, it was pretty perfect — almost too perfect…

Yep, another stock image.

Turns out that MBA was fake too. Columbia doesn’t offer MBAs for Public Relations, Advertising or Applied Communications (see below).

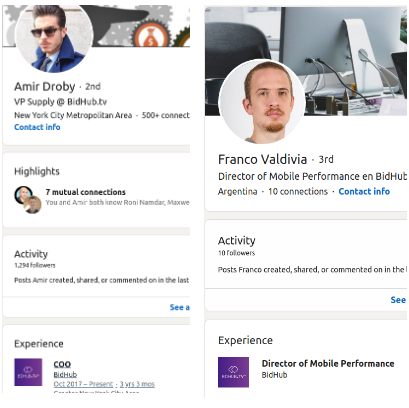

Amir Drobhy and Franco Valdivia

We found similar scenarios for the other people. Amir Drobhy used a stock photo and listed himself as COO of BidHub (that is three COOs if you are keeping track) and his info couldn’t be verified. Franco Valdivia, stock image as well.

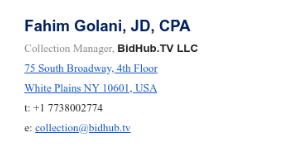

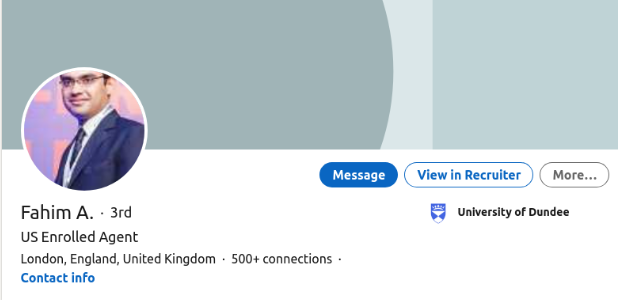

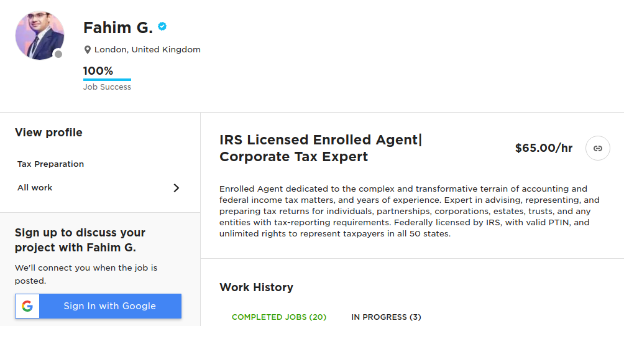

Fahim Golani

Then we dove into Mr. Fahim Golani. He was the one who sent me a nice nasty letter when I informed BidHub I was investigating their traffic.

He had an impressive signature in his email: lawyer and CPA. Being a JD and a CPA is not uncommon if you are a tax attorney, but very odd for one to act as a collections agent or general counsel to a small digital advertising business. It took our team a little time to find Mr. Golani, but we did eventually locate him.

Interestingly enough, there was no law degree listed on this profile. It did list him as dealing with tax, but there was no mention of BidHub or him being a lawyer. He did seem to be a real person, but didn’t otherwise have much in common with the person supposedly emailing us from BidHub. He had an Upwork profile though.

But nothing more than that.

Summary

I spent a lot of hours researching this trying to understand the original issue: why was BidHub getting such low prices for its video inventory? What I learned from analyzing the company was that it was a “Ghost” company; it had no legitimate employees outside Brian Greenwalt himself. Leveraging public and non-public information sources, I could determine that none of the other employees listed on LinkedIn existed, and there were zero employees in the United States. Furthermore, I believe that Fahim Golani was merely the company’s freelance tax advisor found most likely via Upwork, and they impersonated him in their communications with us and possibly others. So BidHub was a company of one person, in my opinion: Brian Greenwalt.

The Scheme

Once I knew BidHub was a “Ghost,” I could confirm my initial suspicion that BidHub was operating a pricing pyramid scheme. It is pretty straightforward: the company promises publishers high cpm’s for their inventory and even guarantees payments. They find small, large and medium publishers to agree. They have them add their ads.txt entries, they pay a third party to let them use their platform to resell the campaigns, and then they connect with SSPs to sell this inventory. The trick is they need to maximize fill across the board. They do this by selling the inventory at less than what they agreed to pay for it. So they tell the publisher they will pay them $8 cpm and sell it to the buyer for $4, for example, to ensure that it gets purchased.

Wait What?

Yes, you read that right: they buy it for more and sell it for less. It sounds stupid until you realize they have no intention of paying all of their publishers. What they do is take 100% of the money paid from the buyers and pay out about 20–30% of it to their publishers, keeping the other 70%. When you factor in the loss of selling the inventory for less than they promised, you come to about a 20–30% profit margin.

Lie, Steal and Cheat

This is the trick to it all: keep some publishers happy so they can give you glowing references to other buyers. Reduce what you owe to other publishers by claiming clawback or fraud. Then don’t pay smaller ones who become unnecessary to the scheme and don’t have the means to sue you. As long as the scheme can keep onboarding new publishers and keeps getting paid, it can float for a few years before the amount of unhappy publishers becomes too large and the company has to fold and start over again.

Get Paid No Matter What

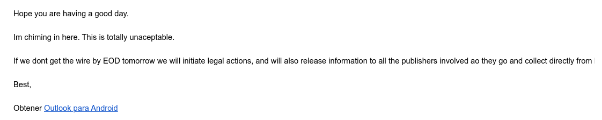

The scheme relies on getting paid and getting paid as fast as possible, because you never know when the jig is up and you have to burn it all down. This is why I received emails like this from Brian Greenwalt when I put a hold on their account and a small portion of the payments were delayed.

It’s a lot like a phone scammer — pay me my money or I will destroy you. I will call your parents, your work, yada yada yada. Its purpose is to make people panic and cough up money.

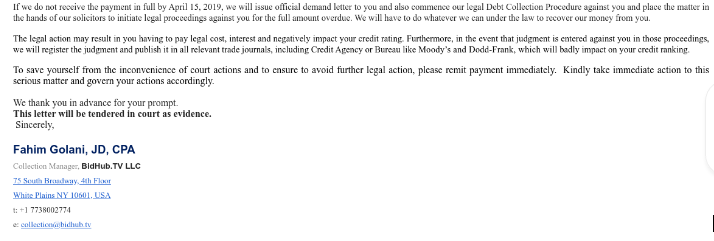

BidHub upped their efforts with language like this:

More threats and scare tactics to make people pay up, even though contractually certain amounts weren’t due. More to the point, they knew I was investigating them for fraudulent activities and, per the contract, would not be entitled to payment for impressions generated from fraud. The delay in money meant they were too extended in the scheme — they had too many publishers demanding money, and not enough money to keep enough of them happy to continue the scheme. This meant they were close to having to burn and run, and if they did that they couldn’t then collect money from other buyers, leaving a large payout behind them.

Why did the scheme work as long as it did?

The majority of digital advertising budgets are spent in the US, and it is very difficult to break into this market without a presence here. So it was not a surprise to see Mr. Greenwalt employ fake profiles and offices to make it appear like his business operated in the US. We tend to scrutinize companies from the US less than we do from other areas. He focused on videos because it was the highest margin business and allowed him to float the scheme for longer.

The Consequence

I take a very hard line on any fraudulent activity, and so does the State of New York. In fact it is one of the few states that has a law surrounding criminal impersonation, a type of fraud (PEN § 190.25).

BidHub’s actions were criminal fraud, not ad fraud. Buyers did run ads on the properties they thought. The issue is that the publishers weren’t getting paid, and in some cases being told that it was the buyer that was the reason for it, thus making the publisher believe the buyer was the bad guy, not BidHub. You can see how this is extremely damaging to the ecosystem.

The Aftermath

I brought this information to partners and notified others in the space of what I detected. Soon after, BidHub.tv websites went down, and the only thing that remained was the fake profiles on LinkedIn.

I don’t know how many publishers were defrauded in this scheme from BidHub. I do know that Mr. Greenwalt is still in the space and even attempted to work with me with his new company again, which I politely declined. There are lots of ways these types of pyramid schemes can occur in ad tech. Sadly they occur all too often, and since the buyers almost never know about them, they don’t know their reputation is being harmed.

We are so focused in the supply realm of the traffic quality and ads.txt relationship, we don’t stop to consider that those relationships themselves may be a product of fraud. This is why it is vital for both publishers and advertisers to thoroughly vet ad tech partners and not simply trust what LinkedIn tells them.